Open Additional Account

Save more, your way. Easily open a free extra savings account to organise and grow your money with flexibility.

Find out moreSave more, your way. Easily open a free extra savings account to organise and grow your money with flexibility.

Find out moreAt Northern Community Bank, we are committed to protecting your privacy and handling your personal data responsibly. This notice outlines how and why we collect, use, share, and store your information and your rights under the Data Protection Act 2018.

Northern Community Bank is the trading name of Pennine Community Credit Union Ltd. registered office is at: 31-39 Manchester Road, Burnley, Lancashire, BB11 1HG and we are a company registered in England and Wales under company number IP00062C. Firm Registration Number (FRN): 213244.

We ask for information marked as mandatory either to meet legal obligations or to deliver our services effectively. If you are unable to provide this information, we may not be able to open or maintain your account. If we request additional details that are not legally or contractually required, we will always ask for your consent.

We may collect and process the following categories of information:

Personal & Contact Information:

– Name, address, contact details,

– Date of birth, nationality,

– National identifiers (National Insurance number, Tax Identification Number).

Financial & Transactional Data:

– Financial history and circumstances,

– Bank details,

– Account transactions and payment details,

– Income and expenditure details (e.g. bank statements, proof of income).

– Income, expenditure, and circumstance information, which may be used for analytical or statistical purposes, including the development of affordability matrices and other internal reports. Where practicable, such data will be anonymised or aggregated.

Contractual Information:

– Products and services you hold with us,

– Application details and agreements.

Technical & Behavioural Data:

– IP address and device information,

– Website and portal usage data,

– Behaviour relating to financial services.

Socio-demographic Data:

– Employment information,

– Income grouping and demographic indicators,

– Housing status.

Locational Data:

– Login locations or device-based location data.

Communications & Documentary Data:

– Emails and messages,

– Identity documents (passport, driving licence, proof of address etc.)

Open Data & Public Records:

– Electoral register records,

– Insolvency records,

– Information you make public online.

Family or Social Relationship Data:

– Beneficiary information (you must make them aware),

– Number of children,

– Marital status.

Preferences & Consents:

– Marketing preferences,

– Accessibility format preferences.

Special Categories of Personal Data:

We only collect these where legally allowed:

– Racial or ethnic origin,

– Political/religious beliefs,

– Trade union membership,

– Health data,

– Biometric or genetic data,

– Sexual orientation,

– Criminal convictions or allegations.

Credit Reference Agency (CRAIN) Data:

We use CRAs (Experian, Equifax, TransUnion) to:

– Confirm identity,

– Assess creditworthiness,

– Manage your account,

You can view the full CRAIN document at: www.experian.co.uk/crain, www.equifax.co.uk/crain, www.transunion.co.uk/crain.

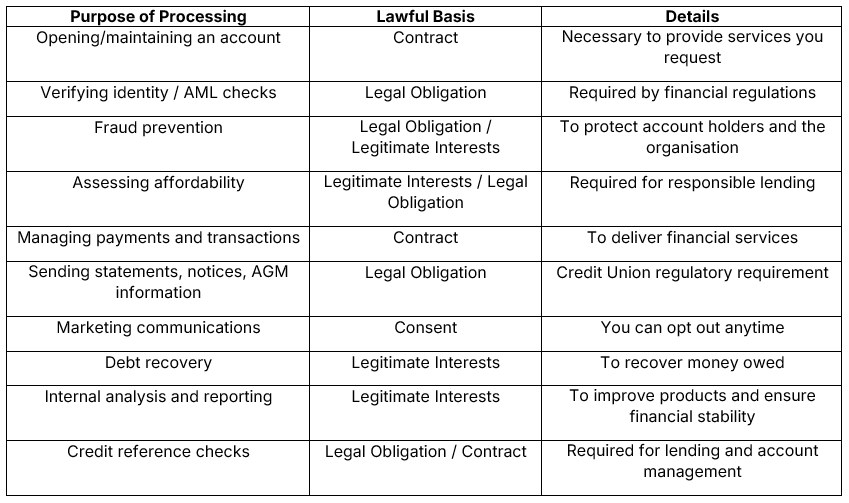

Northern Community Bank may process, transfer and/or share personal data for the following purposes:

To meet legal requirements:

– Confirming your identity

– Preventing financial crime

– Internal and external audits

– Maintaining a register of account holders

To fulfil our contract with you:

– Managing your account(s) and services;

– Processing applications;

– Conducting credit checks and sharing credit references;

– Performing statistical analysis to improve our services;

– Sending statements, updated terms and conditions, changes to your account, and notices of our AGM.

For our legitimate interests:

– Recovering any debts owed.

With your consent:

– Maintaining our relationship with you, including marketing.

We may collect information from:

– Account Holder’s directly;

– CCTV footage, or other recorded images;

– Debt collection agencies;

– Insurance providers;

– Legal and judicial sector organisations;

– Publicly available sources;

– Credit reference agencies;

– Fraud prevention agencies;

– Employer or payroll service providers,

– Firms providing data services,

– Other financial services,

– Insolvency practitioners,

– Government bodies,

– Courts,

– Any other third party you authorised.

We will only share your personal information outside of Northern Community Bank when necessary and appropriate. This may include:

– Identity verification (e.g. to comply with anti-money laundering laws);

– Credit reference and debt recovery agencies;

– Any authorities if compelled to do so by law (e.g. to HM Revenue & Customs to fulfil tax compliance obligations);

– Fraud prevention organisations;

– Any persons, including, but not limited to, insurers, who provide a service or benefits to you or for us in connection with your account(s);

– Our suppliers in order for them to provide services to us and/or to you on our behalf;

– Anyone in connection with a reorganisation or merger of the community bank’s business;

– Other parties for marketing purposes (if you have agreed to this).

We do not directly send your information outside of the European Economic Area (EEA). However, service providers or partner organisations may process data outside the EEA. In such cases, appropriate safeguards will be in place.

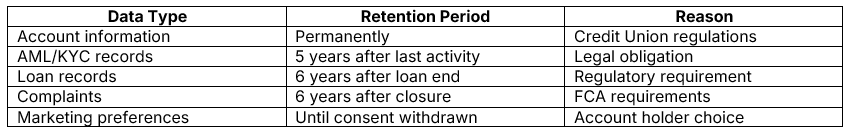

We retain personal data for as long as necessary to fulfil the purposes outlined in this notice. This includes holding data for a period after your account has been closed. For our full retention policy, please contact us on:

📧hello@northerncb.uk

📞 01282 691333

Under data protection law, you have the right to:

– The right to access;

– The right of rectification;

– The right to erasure (applicable only where the data is not required to be retained for regulatory purposes);

– The right to restrict processing;

– The right to data portability;

– The right to object to data processing;

– Rights related to automating decision-making and profiling;

– Right to withdraw consent;

– The right to complain to the Information Commissioner’s Office (ICO).

More details are available on our website: www.northerncommunitybank.co.uk or in any of our branches

To exercise any of your rights or for more information, please contact us at:

📧 hello@northerncb.uk

📞 01282 691333

We aim to respond within one month. If we need more time, we will let you know.

Northern Community Bank

31–39 Manchester Road

Burnley, Lancashire

BB11 1HG

ICO Registration Number: Z6199079

Data Protection Officer: Compliance Manager

📞 01282 691333

📧 hello@northerncb.uk

If you’re unhappy with how we’ve used your data, please contact us directly. If you’re not satisfied with our response, you can raise a complaint with the ICO:

Information Commissioner’s Office

Wycliffe House, Water Lane

Wilmslow, Cheshire

SK9 5AF

📞 0303 123 1113

🌐 www.ico.org.uk/make-a-complaint

We may update this notice from time to time. You can view the latest version on our website at www.northerncommunitybank.co.uk, or request a copy via hello@northerncb.uk or at any of our branches. We’ll inform you of any significant changes and request your consent where necessary.

Our AI chatbot does not collect or use any personal data from users during interactions, if you choose to upload or provide personal data during your use of the chatbot, that information will be handled in accordance with our Privacy Policy. We are committed to safeguarding your privacy and will ensure that any personal data you provide is treated securely and used solely for the purposes outlined in our policy. However, due to the unstructured nature of the data if personal data is included it is not possible to find and delete this data.